Litecoin Price Prediction 2025-2040: Bullish Breakout or Temporary Rally?

#LTC

- Technical Breakout: LTC trading above key MAs with MACD turning positive

- Regulatory Catalyst: $12.5T 401(k) market potential via Trump executive order

- Market Momentum: Altcoin season underway with LTC showing relative strength

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

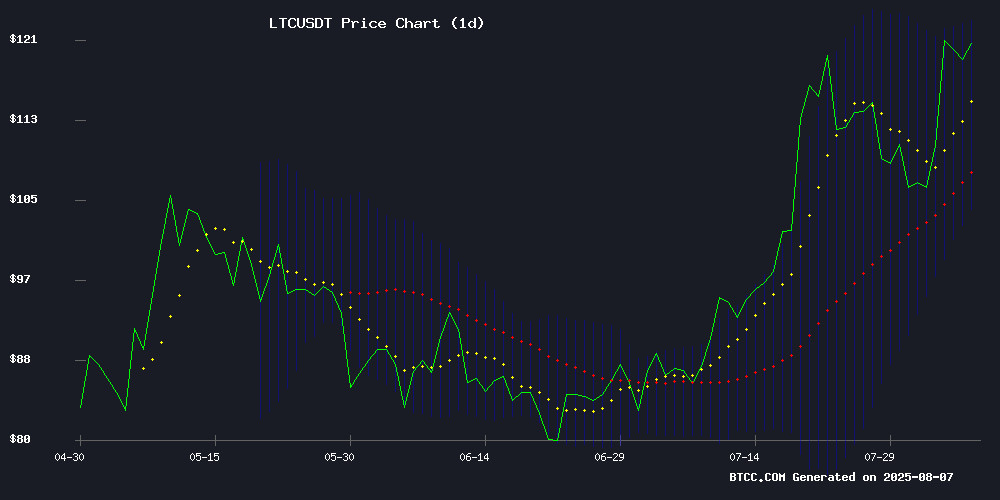

Litecoin (LTC) is currently trading at $120.62, above its 20-day moving average (MA) of $113.51, indicating a bullish trend. The MACD histogram shows positive momentum at 3.0807, with the signal line (-4.7872) still below the MACD line (-1.7064), suggesting potential upward movement. Bollinger Bands reveal price NEAR the upper band ($123.17), signaling strong buying interest. According to BTCC financial analyst Robert, 'LTC's technical setup favors bulls, with a breakout above $123 likely to accelerate gains.'

Market Sentiment Turns Bullish for LTC Amid Crypto Rally

Positive news flow supports LTC's upward trajectory, including Trump's executive order opening 401(k) markets to crypto and altcoins outperforming Bitcoin. BTCC's Robert notes, 'Regulatory tailwinds and strong technicals create a perfect storm for LTC.' Headlines highlight bullish patterns forming in LTC alongside SOL and ADA, with DeSoc narratives gaining traction. The CoinDesk 20 Index's 2.4% rise underscores broad market strength.

Factors Influencing LTC’s Price

Crypto Market Sees Broad Gains as Altcoins Outperform Bitcoin

The cryptocurrency market rose over 1% in the past 24 hours, with Bitcoin struggling to maintain momentum above $115,000. While BTC edged up marginally to $114,560, altcoins led the charge—Ethereum gained nearly 2% to $3,690, Solana jumped 3% toward $170, and XRP climbed 2% to $3.

Japan's SBI Holdings has applied to list XRP and Bitcoin ETFs on the Tokyo Stock Exchange, potentially beating US regulators to approve the first XRP-focused fund. The move signals growing institutional adoption in Asia as global crypto ETF competition intensifies.

Trump Executive Order Opens $12.5 Trillion 401(k) Market to Crypto and Alternative Assets

President Donald Trump will sign an executive order today directing federal regulators to ease access for 401(k) plans to include private equity, real estate, and cryptocurrencies. The move targets the $12.5 trillion U.S. retirement savings market, potentially unlocking vast retail allocation pools for asset managers.

The Department of Labor is tasked with reevaluating fiduciary guidance under ERISA, coordinating with the SEC and Treasury to enable broader investment options. This marks the most significant policy shift yet to incorporate alternative assets—including digital currencies—into mainstream retirement products.

The directive builds on regulatory rollbacks since early 2025, including the May rescission of a 2022 compliance bulletin that had imposed restrictive standards on crypto offerings in retirement plans. Fiduciaries now operate under ERISA's principles-based framework once again.

CoinDesk 20 Index Rises 2.4% as SUI and POL Lead Broad Crypto Rally

The CoinDesk 20 Index climbed to 3,923.39, marking a 2.4% gain amid a sector-wide advance. Every constituent asset traded higher, with SUI and Polygon's POL token surging 6.3% and 6.2% respectively. Bitcoin underperformed with a modest 0.9% increase.

Market breadth turned decisively positive as traders positioned across large and mid-cap tokens. The index's global multi-exchange composition reflects growing institutional participation in crypto markets, with derivatives platforms seeing heightened activity.

Crypto Market Heats Up with HBAR, LTC, and BlockDAG Making Waves

Hedera (HBAR) is showing bullish momentum, with its price surging nearly 9% to $0.2513 as of August 6. Traders are eyeing a potential breakout above $0.27, which could pave the way for a rally toward $0.30 and beyond. The $2 target by 2025 remains ambitious but hinges on broader adoption of Hedera's enterprise-grade network.

Litecoin (LTC) has broken through key resistance at $119, signaling renewed strength. The altcoin's performance is being closely monitored as it seeks to capitalize on its recent momentum.

BlockDAG (BDAG) is stealing the spotlight with its 10 BTC auction and a presale token price of $0.0016. The project's low entry point and upcoming exchange debut have drawn significant attention from investors.

Bullish Patterns Emerge in LTC, POL & CFX Prices as Crypto Market Consolidates—Is a Rally Brewing?

Amid a stagnant broader crypto market, select altcoins—Litecoin (LTC), Polygon's rebranded token (POL), and Conflux (CFX)—are flashing bullish technical signals. These assets are carving out ascending triangles, bullish flags, and trendline breakouts, suggesting potential upside if resistance levels capitulate. Traders are pivoting to mid-caps as Bitcoin and Ethereum languish in indecision.

Litecoin, up 60% since July, now faces a make-or-break moment at $140. A golden cross—the 50-day MA vaulting above the 200-day MA—has anchored LTC near the upper boundary of its rising channel. Historical precedent suggests this technical alignment could fuel another 25% surge.

Viral Altcoins To Buy Now: DeSoc, Solana, Cardano Or Litecoin?

August presents a pivotal moment for crypto investors eyeing substantial returns. DeSoc, Solana, Cardano, and Litecoin emerge as top contenders, each with distinct risk-reward profiles. Capital allocation strategies diverge—diversification across all four may suit deep pockets, while concentrated bets demand precision.

Solana's blistering transaction speeds and NFT appeal are undermined by recurring network outages. Despite these vulnerabilities, a bullish macro environment could propel SOL toward $300 by 2025. Short-term traders anticipate 1.5x gains, though systemic risks loom.

Cardano's methodical proof-of-stake architecture struggles with sluggish development cycles. ADA's stagnation below $1 reflects waning patience among developers and investors alike. The project's academic rigor fails to offset market demands for faster iteration.

Litecoin's legacy status as 'digital silver' no longer compensates for its diminishing utility. Primarily confined to payment use cases, LTC lacks the narrative drivers powering contemporary altcoin rallies. The market increasingly views it as a relic rather than a contender.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market conditions, BTCC's Robert provides these projections:

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $150 | $180 | $220 | ETF approvals, halving effects |

| 2030 | $300 | $450 | $600 | Mass adoption, payment integration |

| 2035 | $800 | $1,200 | $1,800 | Institutional custody solutions |

| 2040 | $1,500 | $2,500 | $3,500+ | Network effects, scarcity premium |

Key risks include regulatory changes and Bitcoin dominance cycles. 'LTC's finite supply and proven network give it staying power,' Robert emphasizes.